In today's digital landscape, where online platforms and data-driven systems dominate every aspect of business operations, security and compliance have become paramount. For platforms like BClub, which handle sensitive payment and customer data, maintaining robust access controls, adhering to bclub PCI DSS (Payment Card Industry Data Security Standards), and implementing effective incident response measures are not just best practices—they're essential components of responsible operations.

This article explores the best practices for access management, PCI compliance, and incident response that every organization—especially BClub—should prioritize to ensure the integrity, confidentiality, and availability of customer data.

1. Understanding the Security Landscape

Before diving into specific practices, it's crucial to understand why these elements matter. In the digital era, cyber threats evolve rapidly. Data breaches, credential theft, phishing, and payment fraud are becoming increasingly sophisticated. Platforms managing financial transactions or personal information are high-value targets.

BClub, like other payment-related or e-commerce platforms, must balance user convenience with stringent security controls. Strong access management ensures only authorized individuals can interact with sensitive data. PCI compliance guarantees that data handling processes meet global security standards. Finally, an incident response plan ensures rapid mitigation when something goes wrong.

2. Access Management: The First Line of Defense

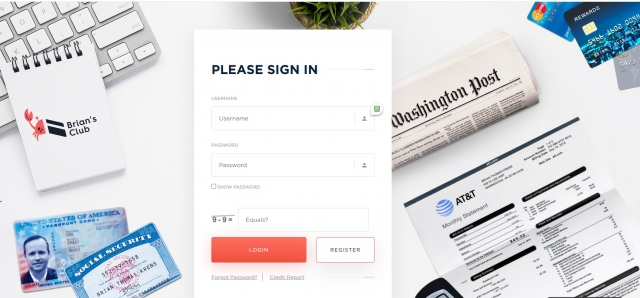

bclub new domain login Access management refers to the methods used to control who can access what data and under what circumstances. It's the cornerstone of cybersecurity and compliance. For a platform like BClub, poor access control could open the door to internal misuse or external breaches.

Best Practices for Access Management

- Principle of Least Privilege (PoLP):

Every user should have the minimum level of access required to perform their duties. This minimizes the risk of insider threats and limits damage in case of credential compromise. - Role-Based Access Control (RBAC):

Define clear roles (admin, analyst, user, auditor) and assign permissions accordingly. RBAC ensures consistency and reduces the chance of accidental over-permissioning. - Multi-Factor Authentication (MFA):

MFA adds an extra layer of protection by requiring users to verify their identity using two or more authentication factors (e.g., password + one-time code). For financial and administrative accounts, MFA should be mandatory. - Session Management and Timeouts:

Automatically log out inactive sessions to reduce the risk of unauthorized access on unattended devices. - Regular Access Reviews:

Periodically audit access rights to ensure they remain appropriate as employees change roles or leave the organization. - Secure Credential Management:

Use password managers, enforce complex passwords, and rotate credentials regularly. Never hardcode credentials in scripts or shared repositories.

By following these steps, BClub can maintain a zero-trust approach to access control, ensuring only verified users gain entry to sensitive environments.

3. PCI Compliance: Protecting Payment Data

When dealing with payment card information, PCI DSS compliance is non-negotiable. It ensures that organizations processing, storing, or transmitting credit card data maintain a secure environment. For BClub, PCI compliance establishes credibility and minimizes the risk of financial penalties or reputational damage.

Key Principles of PCI DSS

- Build and Maintain a Secure Network and Systems:

Firewalls, intrusion prevention systems, and network segmentation should isolate sensitive systems from public networks. - Protect Cardholder Data:

Encrypt all cardholder data both in transit (using TLS 1.2 or higher) and at rest (using AES-256 or similar). Never store sensitive authentication data after authorization. - Maintain a Vulnerability Management Program:

Keep systems updated, apply patches promptly, and use anti-malware tools to safeguard against evolving threats. - Implement Strong Access Control Measures:

Access to cardholder data should be strictly limited to authorized personnel, reinforced by MFA and detailed audit trails. - Regularly Monitor and Test Networks:

Conduct penetration tests, vulnerability scans, and continuous monitoring to detect and mitigate risks early. - Maintain an Information Security Policy:

Establish and enforce security policies that cover all personnel handling payment data.

PCI Compliance in Practice at BClub

BClub can enhance PCI compliance by integrating automated compliance management tools that continuously scan for policy deviations. Regular training sessions for staff handling payment information are also vital. Additionally, BClub should collaborate with certified PCI auditors to perform annual assessments and maintain up-to-date compliance documentation.

By embedding PCI DSS principles into its operational DNA, BClub ensures not only legal compliance but also user trust and data protection.

4. Incident Response: Preparing for the Unexpected

Even the most secure platforms can face security incidents. What differentiates successful organizations from vulnerable ones is how quickly and effectively they respond to threats.

An incident response plan (IRP) outlines the steps to detect, contain, eradicate, and recover from security breaches. For BClub, a strong IRP ensures that data breaches, malware infections, or unauthorized access attempts are managed swiftly to minimize damage.

Key Components of an Effective Incident Response Plan

- Preparation:

- Define the incident response team (IRT) roles and responsibilities.

- Establish secure communication channels for emergencies.

- Train staff regularly with simulated incident drills.

- Identification:

- Monitor logs and alerts for unusual activity (e.g., failed logins, data exfiltration).

- Use AI-driven security tools for real-time anomaly detection.

- Containment:

- Isolate affected systems to prevent further compromise.

- Preserve digital evidence for forensic analysis.

- Eradication:

- Identify root causes (malware, misconfiguration, insider threat) and remove them completely.

- Apply patches and update firewall rules if necessary.

- Recovery:

- Restore systems from clean backups.

- Monitor restored environments for signs of recurring issues.

- Lessons Learned:

- Conduct post-incident reviews.

- Update policies, training, and controls based on findings.

A proactive response culture ensures that when incidents occur, BClub can act decisively—reducing downtime, financial losses, and reputational harm.

5. Integrating the Three Pillars

Access management, PCI compliance, and incident response are interconnected. Access controls support PCI compliance by safeguarding cardholder data. PCI standards, in turn, require continuous monitoring and incident management. Incident response closes the loop by detecting and correcting any failures in the other two areas.

For BClub, integrating these elements into a unified security framework means establishing continuous improvement cycles:

- Access audits feed into compliance assessments.

- Compliance findings inform incident response plans.

- Incident outcomes refine access control rules and compliance posture.

This holistic approach fosters resilience, trust, and operational excellence.

6. Continuous Improvement and Future Outlook

Cybersecurity is not static. Threats evolve, regulations tighten, and technologies advance. Therefore, BClub should treat security as a continuous journey rather than a one-time certification. Regular risk assessments, threat intelligence updates, and security awareness programs should remain integral to its strategy.

Emerging technologies like AI-driven threat detection, zero-trust architecture, and blockchain-based transaction verification can further strengthen data security and transparency for platforms like BClub.

Conclusion

For organizations like BClub, excellence in access management, PCI compliance, and incident response defines the foundation of secure operations. By enforcing strict access controls, adhering to global compliance standards, and maintaining a proactive incident response strategy, BClub can protect sensitive payment data, uphold customer trust, and ensure uninterrupted business continuity.

In a world where data security equals brand reputation, BClub's commitment to these best practices is not just a regulatory requirement—it's a competitive advantage.